Our Dental Debt Collection PDFs

Table of ContentsSome Of Dental Debt CollectionThe 9-Minute Rule for Private Schools Debt CollectionHow Debt Collection Agency can Save You Time, Stress, and Money.The Best Guide To Personal Debt Collection

The debt purchaser acquires just a digital documents of details, frequently without sustaining evidence of the financial obligation. The financial debt is likewise generally very old financial debt, sometimes referred to as "zombie debt" because the financial debt customer attempts to revitalize a financial obligation that was past the law of limitations for collections. Financial debt collection companies might contact you either in writing or by phone.

:max_bytes(150000):strip_icc()/tactics-for-paying-off-debt-collections-960596-final-dd5c75985b904e46b8d1bd8e0a9f4d77.jpg)

Yet not speaking with them won't make the debt go away, and they may just try alternative methods to contact you, including suing you. When a financial obligation collection agency calls you, it is essential to get some initial information from them, such as: The debt enthusiast's name, address, and also contact number. The complete amount of the financial obligation they declare you owe, consisting of any charges as well as passion costs that might have built up.

Our Personal Debt Collection Statements

The letter has to specify that it's from a financial debt collection agency. Call and also deal with of both the debt collection agency and the debtor. The creditor or financial institutions to whom the debt is owed. An inventory of the debt, including charges and also passion. They have to additionally inform you of your rights in the debt collection procedure, as well as how you can challenge the financial obligation.

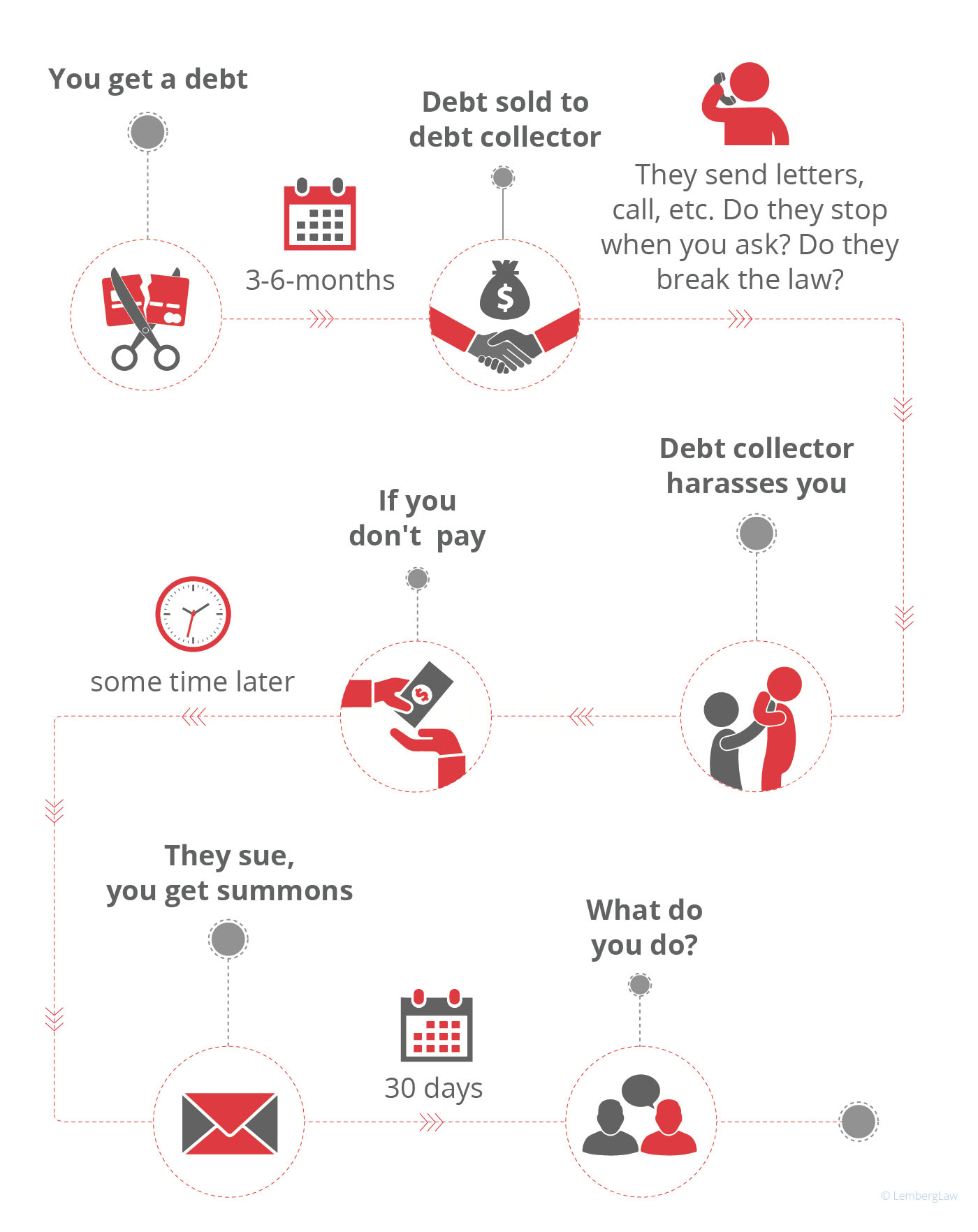

If you do contest the debt within thirty days, they have to stop collection efforts till they offer you with proof that the debt is your own. They need to offer you with the name as well as address of the initial lender if you ask for that info within one month. The debt recognition notice must consist of a type that can be made use of to contact them if you want to dispute the financial obligation.

Some things financial obligation collectors can refrain from doing are: Make duplicated phone call to a borrower, planning to annoy the debtor. Intimidate physical violence. Use obscenity. Lie concerning just how much you owe or act to call from a main government workplace. Generally, debt is reported to the credit score bureaus when it's thirty days past due.

If your financial debt is moved to a financial obligation collector or marketed to a financial debt customer, an entrance will certainly be made on your debt record. Each time your financial obligation is sold, if it remains to go overdue, another access will be included in your credit scores report. Each unfavorable entrance on your credit history record can stay there for as much as seven years, even after the debt has been paid.

What Does Debt Collection Agency Do?

What should you anticipate from visit this website a collection agency and also just how does the process job? When you've made the choice to employ a collection agency, make sure you pick the appropriate one.

Some are much better at getting results from larger organizations, while others are competent at accumulating from home-based companies. Ensure you're collaborating with a business that will really offer your demands. This might appear obvious, but before you hire a debt collection agency, you require to make certain that they are my sources certified and also accredited to act as debt collection agencies.

Before you start your search, recognize the licensing needs for debt collector in your state. That means, when you are talking to companies, you can speak intelligently concerning your state's needs. Contact the companies you talk with to guarantee they fulfill the licensing needs for your state, specifically if they lie elsewhere.

You should also examine with your Better Company Bureau as well as the Business Debt Collection Agency Organization for the names of trusted as well as highly concerned financial obligation collectors. While you may be passing along these debts to an enthusiast, they are still representing your business. You need to know how they will certainly represent you, exactly how they will certainly collaborate with you, and also what appropriate experience they have.

How Business Debt Collection can Save You Time, Stress, and Money.

Just due to the fact that a method is legal does not mean that it's something you desire your business name related to. A respectable financial obligation enthusiast will certainly collaborate with you to outline a plan you can live with, one that treats your previous clients the means you would certainly wish to be treated and also still finishes the job.

If that happens, one strategy several agencies make use of is avoid mapping. That means they have access to certain data sources to assist locate a debtor who has left no forwarding address. This can be a great strategy to ask concerning specifically. You should likewise explore the enthusiast's experience. Have they collaborated with firms in your market before? Is your circumstance outside of their experience, or is it something they are acquainted with? Pertinent experience boosts the probability that their collection efforts will achieve success.

You should have a factor of get in touch with that you can interact with and receive updates from. Business Debt Collection. They need to have the ability pop over to these guys to plainly verbalize what will be gotten out of you at the same time, what information you'll require to give, as well as what the tempo as well as sets off for interaction will be. Your picked company should have the ability to accommodate your picked communication demands, not require you to accept their own

Ask for proof of insurance coverage from any kind of collection agency to secure on your own. Debt collection is a solution, and also it's not a low-cost one.